Taxation (Gulf - VAT)

Bestseller

Language: Urdu / Hindi

Language: Urdu / Hindi

ABOUT THE COURSE:

This course covers the fundamentals of VAT principles and their global significance,

with a focus on the GCC regulatory landscape. It provides detailed insights into VAT

systems in Bahrain, Oman, and the UAE, explores evolving regulations in KSA, and applies

knowledge through case studies. Key aspects include addressing common challenges,

mastering compliance and reporting essentials, and adopting best practices for seamless

VAT compliance.

ABOUT THIS COURSE :

This course covers VAT fundamentals, focusing on the GCC, with detailed insights into VAT systems in Bahrain, Oman, UAE, and evolving KSA regulations, including compliance, reporting, and best practices.

This Course Includes:

- 20+ hours on-demand video

- 15 Lectures

- 1 Year access time

- Certificate of completion

- 24/7 WhatsApp Support

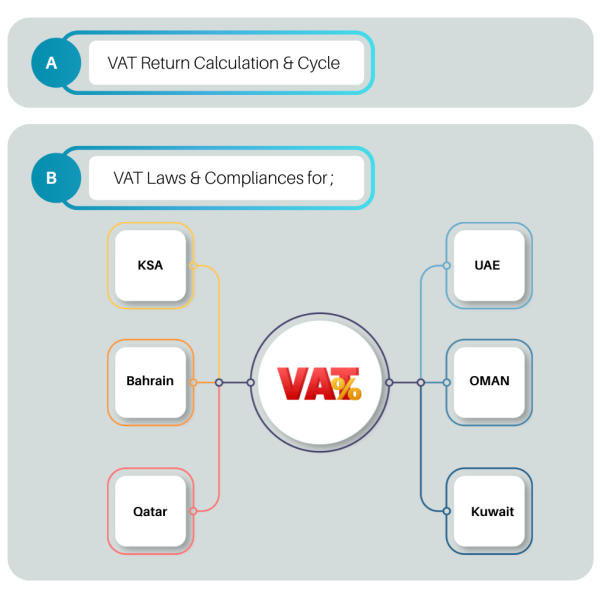

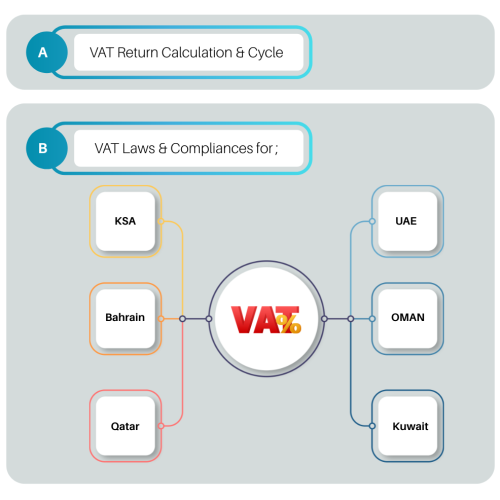

Course Content

• Fundamentals of VAT Principles: – Explore the foundational principles of Value Added Tax (VAT) and its global significance.

• GCC VAT Regulatory Landscape: – Gain an overview of VAT regulations specific to the Gulf Cooperation Council (GCC) countries, understanding regional variations.

• Bahrain’s VAT System: – Examine key aspects of Bahrain’s VAT system, unraveling its structure and unique considerations.

• Oman’s VAT Architecture: – Conduct an insightful exploration of Oman’s VAT structure, analyzing its distinctive features and implications.

• In-Depth Analysis of VAT in the Emirates: – Explore intricate details of VAT in the United Arab Emirates, deciphering complexities and implications for businesses.

Best Practices for Seamless VAT Compliance: – Acquire insights into best practices for achieving seamless VAT compliance, optimizing processes, and mitigating risks effectively.

• Evolving KSA VAT Regulations: – Understand the dynamic landscape of Value Added Tax regulations in the Kingdom of Saudi Arabia (KSA) and stay updated on recent changes.

• Practical Application through Case Studies: – Apply theoretical knowledge to real-world scenarios through insightful case studies, enhancing practical understanding.

• Addressing Common Challenges with Expert Solutions: – Identify and overcome common challenges in VAT implementation with practical solutions provided by industry experts.

• Compliance and Reporting Essentials: – Master the essentials of VAT compliance and reporting, ensuring businesses adhere to regulatory requirements.

Course Content